Note DefesaNet

Text in Portuguese

The Editor

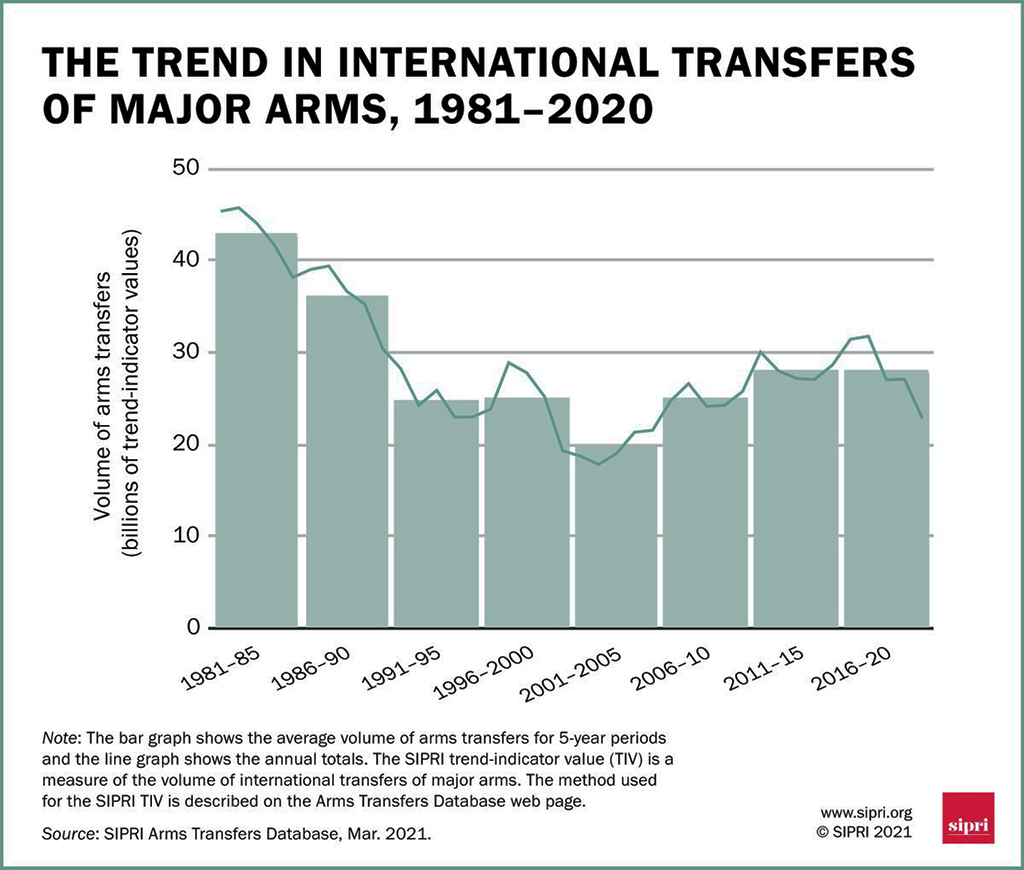

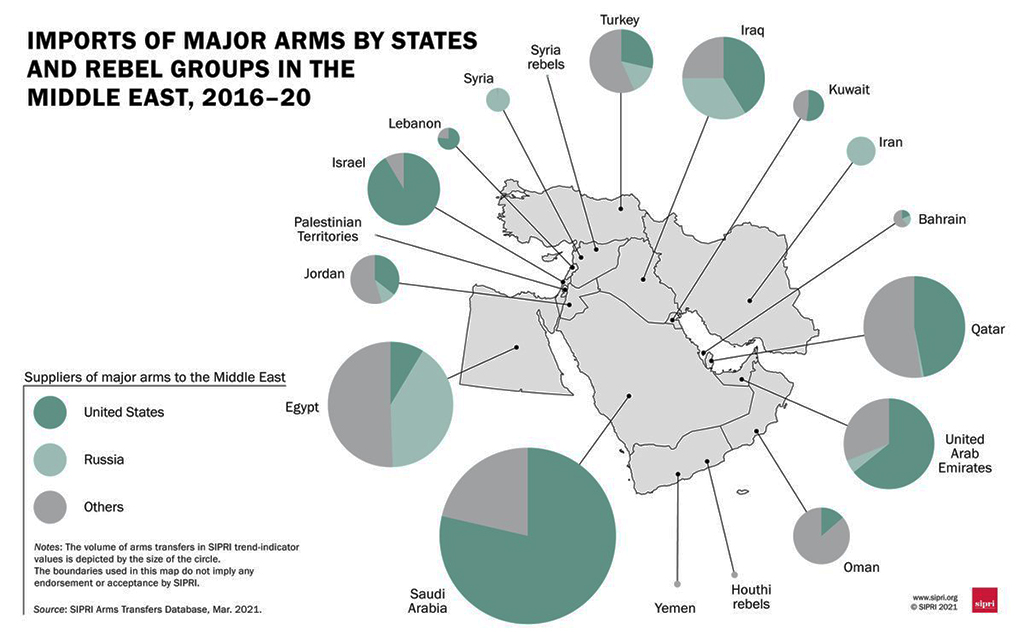

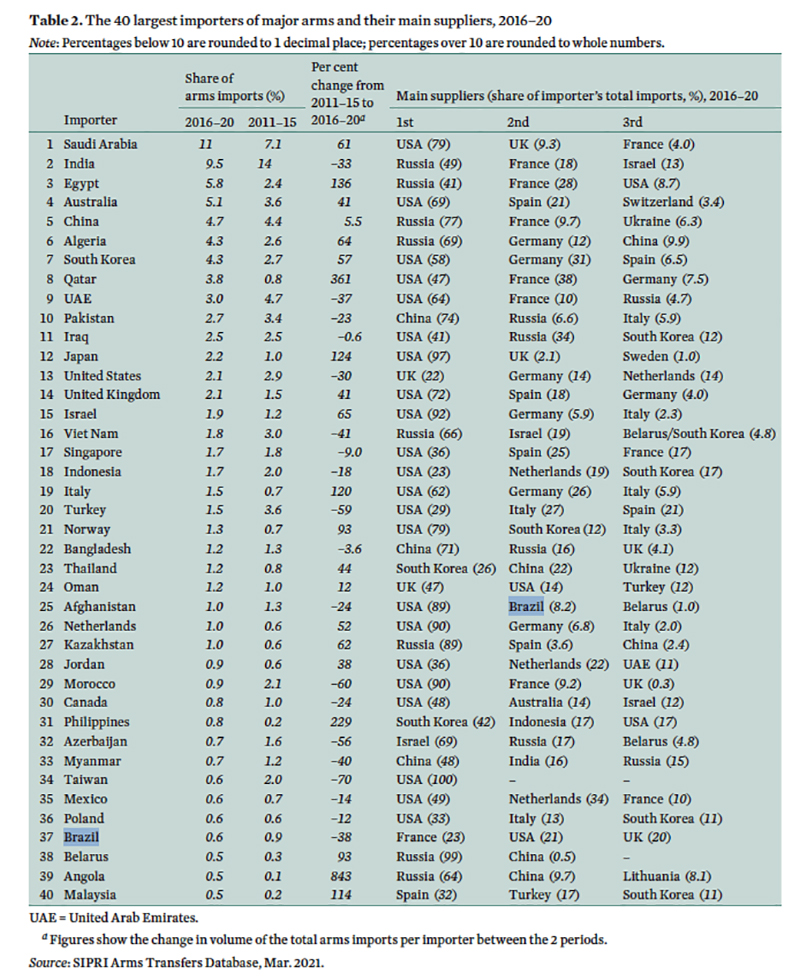

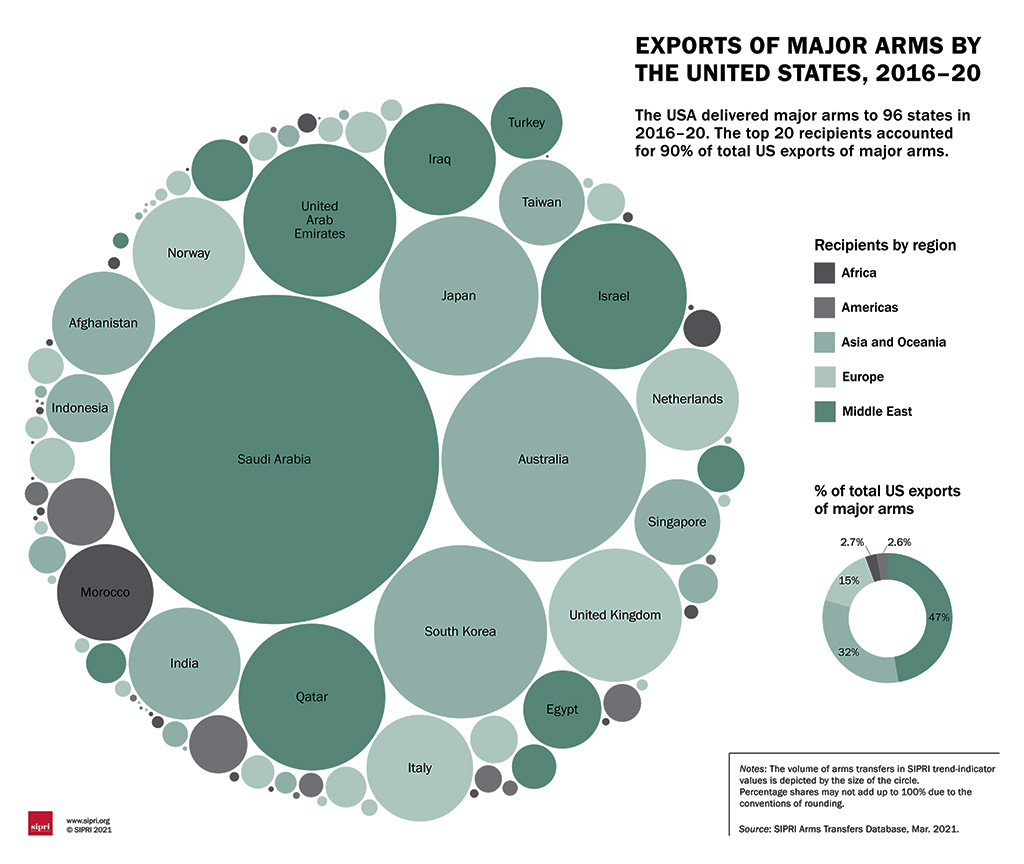

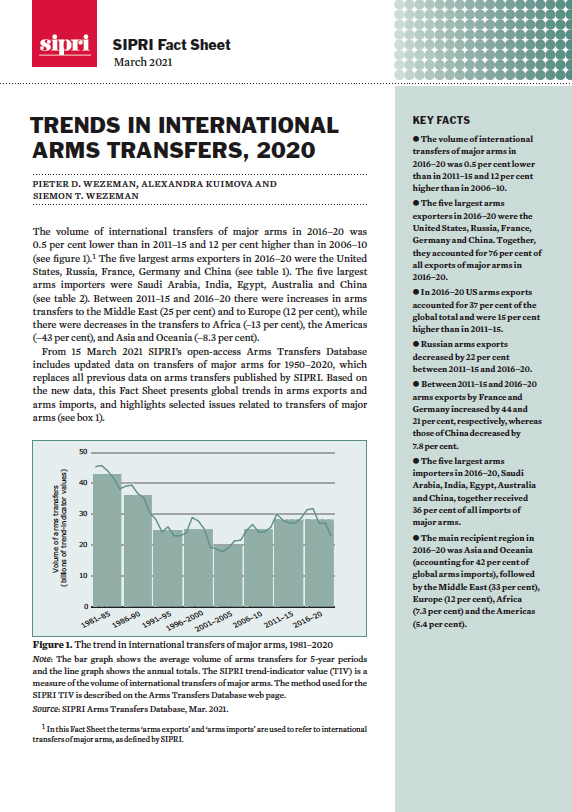

Stockholm, 15 March 2021- International transfers of major arms stayed at the same level between 2011–15 and 2016–20. Substantial increases in transfers by three of the top five arms exporters—the USA, France and Germany—were largely offset by declining Russian and Chinese arms exports. Middle Eastern arms imports grew by 25 per cent in the period, driven chiefly by Saudi Arabia (+61%), Egypt (+136%) and Qatar (+361 %), according to new data on global arms transfers published today by the Stockholm International Peace Research Institute (SIPRI).

For the first time since 2001–2005, the volume of deliveries of major arms between countries did not increase between 2011–15 and 2016–20. However, international arms transfers remain close to the highest level since the end of the cold war.

Click to expand image

‘It is too early to say whether the period of rapid growth in arms transfers of the past two decades is over,’ said Pieter D. Wezeman, Senior Researcher with the SIPRI Arms and Military Expenditure Programme. ‘For example, the economic impact of the Covid-19 pandemic could see some countries reassessing their arms imports in the coming years. However, at the same time, even at the height of the pandemic in 2020, several countries signed large contracts for major arms.’

Click to expand image

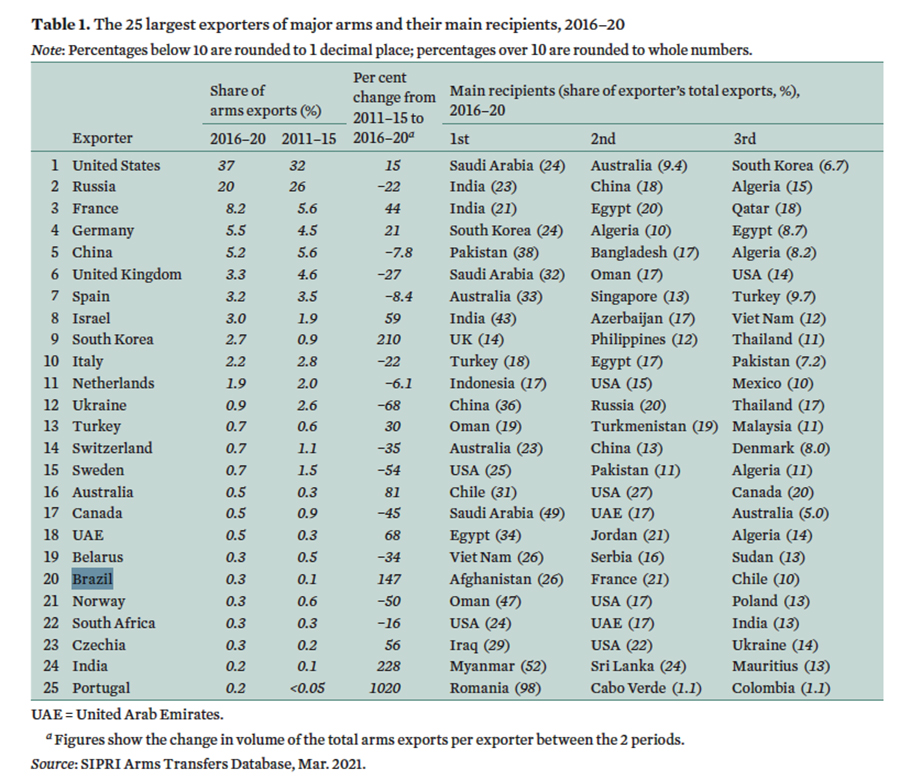

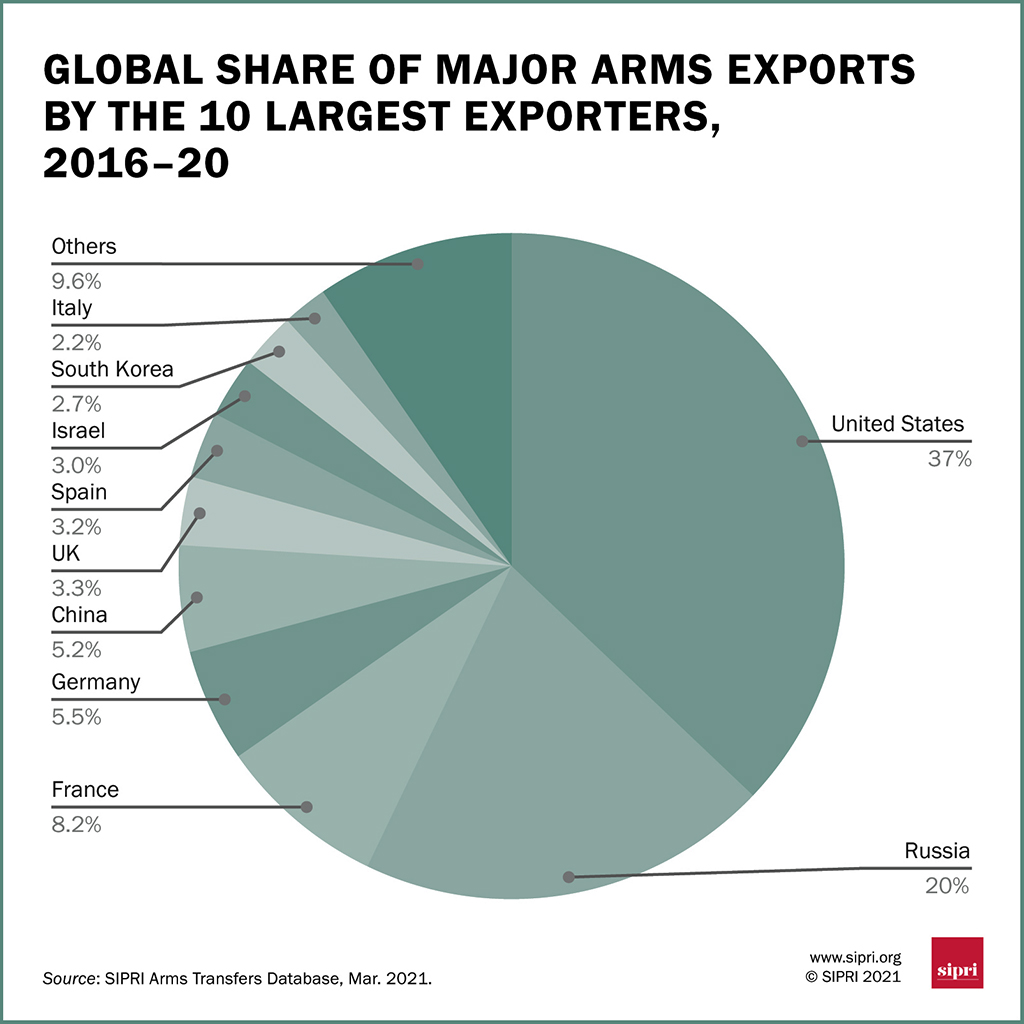

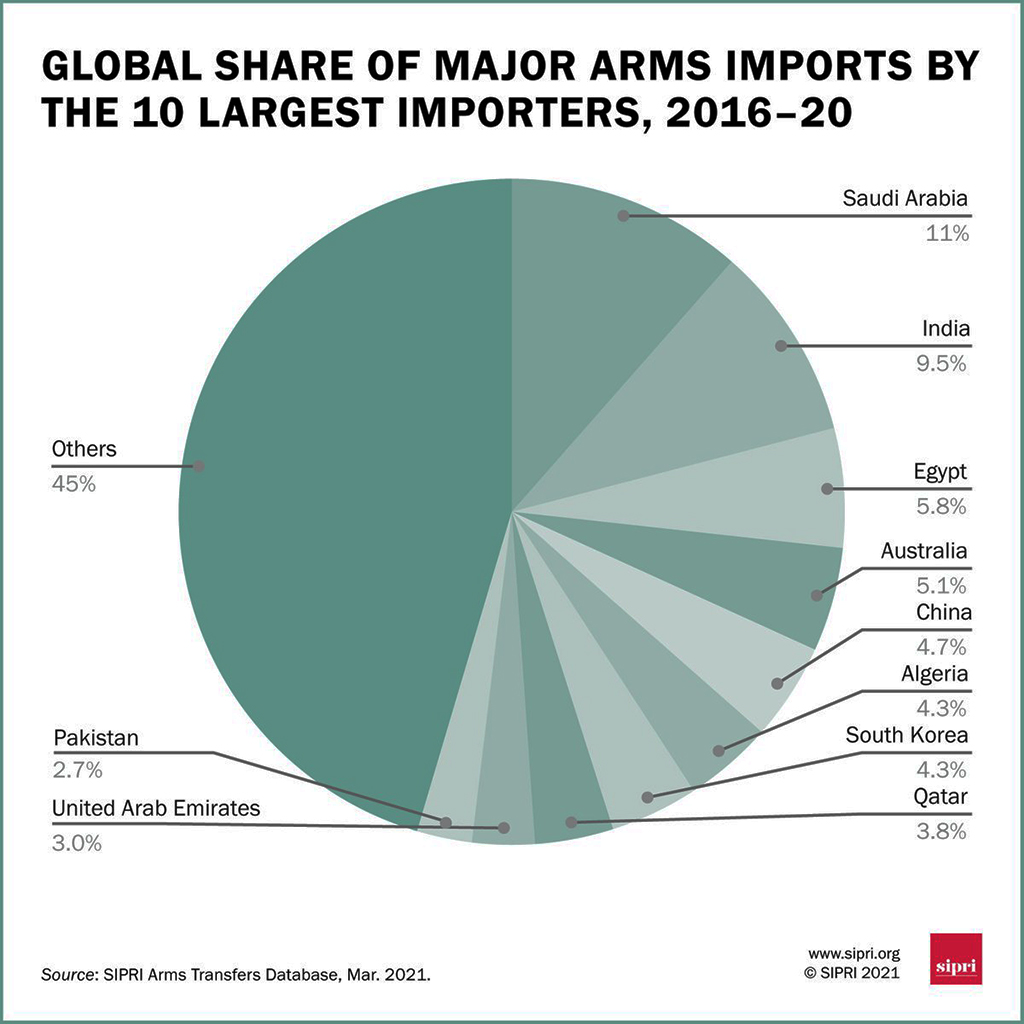

US, French and German exports rise, Russian and Chinese exports fall

The United Statesremains the largest arms exporter, increasing its global share of arms exports from 32 to 37 % between 2011–15 and 2016–20. The USA supplied major arms to 96 states in 2016–20, far more than any other supplier. Almost half (47 %) of US arms transfers went to the Middle East. Saudi Arabia alone accounted for 24 per cent of total US arms exports. The 15 % increase in US arms exports between 2011–15 and 2016–20 further widened the gap between the USA and second largest arms exporter Russia.

The third and fourth largest exporters also experienced substantial growth between 2011–15 and 2016–20. France increased its exports of major arms by 44 % and accounted for 8.2 % of global arms exports in 2016–20. India, Egypt and Qatar together received 59 % of French arms exports.

Germany increased its exports of major arms by 21 % between2011–15 and 2016–20 and accounted for 5.5 % of the global total. The top markets for German arms exports were South Korea, Algeria and Egypt.

Russiaand China both saw their arms exports falling. Arms exports by Russia, which accounted for 20 % of all exports of major arms in 2016–20, dropped by 22 % (to roughly the same level as in 2006–10). The bulk—around 90 per cent—of this decrease was attributable to a 53 per cent fall in its arms exports to India.

‘Russia substantially increased its arms transfers to China, Algeria and Egypt between 2011–15 and 2016–20, but this did not offset the large drop in its arms exports to India,’ said Alexandra Kuimova, Researcher with the SIPRI Arms and Military Expenditure Programme. ‘Although Russia has recently signed new large arms deals with several states and its exports will probably gradually increase again in the coming years, it faces strong competition from the USA in most regions.’

Exports by China, the world’s fifth largest arms exporter in 2016–20, decreased by 7.8 % between 2011–15 and 2016–20. Chinese arms exports accounted for 5.2 % of total arms exports in 2016–20. Pakistan, Bangladesh and Algeria were the largest recipients of Chinese arms.

Click to expand image

Growing demand in the Middle East

The biggest growth in arms imports was seen in the Middle East. Middle Eastern states imported 25 % more major arms in 2016–20 than they did in 2011–15. This reflected regional strategic competition among several states in the Gulf region. Saudi Arabia—the world’s largest arms importer—increased its arms imports by 61 % and Qatar by 361 %. Arms imports by the United Arab Emirates (UAE) fell by 37 %, but several planned deliveries of major arms—including of 50 F-35 combat aircraft from the USA agreed in 2020—suggest that the UAE will continue to import large volumes of arms.

Egypt’s arms imports increased by 136 % between 2011–15 and 2016–20. Egypt, which is involved in disputes with Turkey over hydrocarbon resources in the eastern Mediterranean, has invested heavily in its naval forces.

Turkey’s arms imports fell by 59 per cent between 2011–15 and 2016–20. A major factor was the USA halting deliveries of F-35 combat aircraft to the country in 2019, after Turkey imported Russian air defence systems. Turkey is also increasing domestic production of major arms, to reduce its reliance on imports.

Click to expand image

Imports by states in Asia and Oceania remain high

Asia and Oceania was the largest importing region for major arms, receiving 42 % of global arms transfers in 2016–20. India, Australia, China, South Korea and Pakistan were the biggest importers in the region.

Japan’s arms imports increased by 124 % between 2011–15 and 2016–20. Although Taiwan’s arms imports in 2016–20 were lower than in 2011–15, it placed several large arms procurement orders with the USA in 2019, including for combat aircraft.

‘For many states in Asia and Oceania, a growing perception of China as a threat is the main driver for arms imports,’ said Siemon T. Wezeman, Senior Researcher at SIPRI. ‘More large imports are planned, and several states in the region are also aiming to produce their own major arms.’

Arms imports by India decreased by 33 % between 2011–15 and 2016–20. Russia was the most affected supplier, although India’s imports of US arms also fell, by 46 per cent. The drop in Indian arms imports seems to have been mainly due to its complex procurement processes, combined with an attempt to reduce its dependence on Russian arms. India is planning large-scale arms imports in the coming years from several suppliers.

Click to expand image

Other notable developments:

– Arms exports by the United Kingdom dropped by 27 per cent between 2011–15 and 2016–20. The UK accounted for 3.3 per cent of total arms exports in 2016–20.

– Israeliarms exports represented 3.0 per cent of the global total in 2016–20 and were 59 per cent higher than in 2011–15.

– Arms exports by South Korea were 210 per cent higher in 2016–20 than in 2011–15, giving it a 2.7 per cent share of global arms exports.

– Between 2011–15 and 2016–20 there were overall decreases in arms imports by states in Africa (–13 %), the Americas (–43 %) and Asia and Oceania (–8.3 %).

– Algeria increased its arms imports by 64 % compared with 2011–15, while arms imports by Morocco were 60 % lower.

In 2016–20 Russia supplied 30 % of arms imports by countries in sub-Saharan Africa, China 20 per cent, France 9.5 % and the USA 5.4 %.

– China was the largest arms importer in East Asia, receiving 4.7 % of global arms imports in 2016–20.

– Both Armenia and Azerbaijan have been building up their military capabilities through major arms imports in recent years. In 2016–20 Russia accounted for 94 per cent of Armenian arms imports while Israel accounted for 69 per cent of Azerbaijan’s arms imports.

Click to expand image

Click to expand image

Click to see full document in PDF format